Limited Partnerships

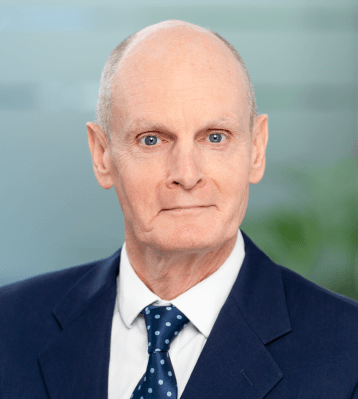

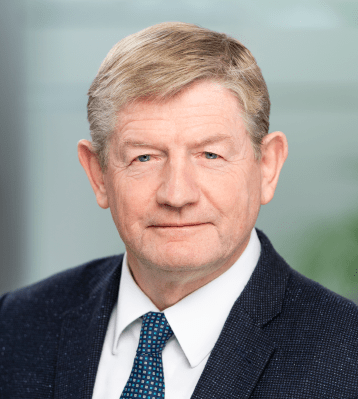

OCWM Law LLP held a virtual briefing session on limited partnerships and the Limited Partnership Act 1907 (“Act”). The Act governs the administration and regulation of limited partnerships in Ireland. A limited partnership will have two categories of partner: a general partner and a limited partner. A limited partner will have limited liability up to the amount of capital that they have contributed. A general partner has unlimited liability for the partnership’s debts and obligations. A limited partnership must be registered with the Companies Registration Office. If a limited partnership is not registered as required by the Act, the limited partner(s) is/are deemed by law to be general partner(s) and so are liable for all the debts and obligations of the partnership. Family limited partnerships can be a useful vehicle for holding investment and/or trading assets for the benefit of a number of family members. Limited partnerships can also be found sitting under regulated fund structures in order to, inter alia, help create a separate security package in a sub-fund structure where limited recourse financing is being provided. If you require further information on limited partnerships and the Act please contact Michael Walshe or Edel Conway of this office.